With the process of bookkeeping, companies can track important financial information that helps management in making crucial decisions. LO 3.5Prepare journal entries to record the following transactions. LO 3.5Journalize each of the following transactions or state no entry required and explain why. Be sure to follow proper journal writing rules. LO 3.5State whether the balance in each of the following accounts increases with a debit or a credit. LO 3.6Prepare an unadjusted trial balance, in correct format, from the alphabetized account information as follows.

Issuing stock

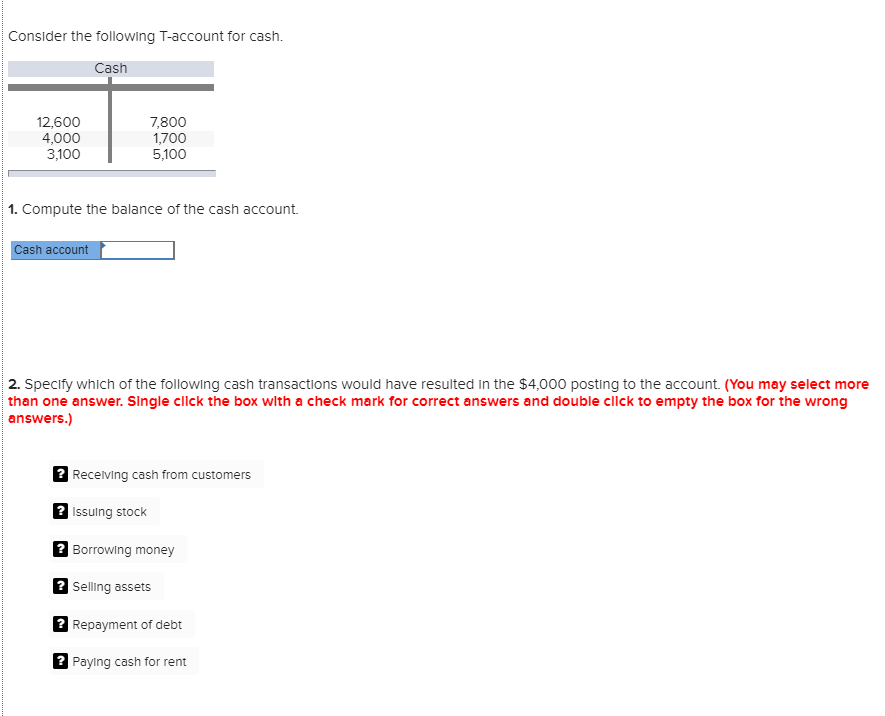

Assume all accounts have normal balances. LO 3.5For each of the following items, indicate whether a debit or a credit applies. LO 3.4Identify the normal balance for each of the following accounts. LO 3.2Consider the following accounts and determine if the account is an asset (A), a liability (L), or equity (E). Compute the balance of the Cash account.

Credit Debit

LO 3.5Discuss how each of the following transactions will affect assets, liabilities, and stockholders’ equity, and prove the company’s accounts will still be in balance. LO 3.2LO 3.4West End Inc., an auto mechanic shop, has the following account balances, given in no certain order, for the quarter ended March 31, 2019. Based on the information provided, prepare West End’s annual financial statements (omit the Statement of Cash Flows). LO 3.5Indicate whether each of the following accounts has a normal debit or credit balance. LO 3.4Identify whether each of the following transactions would be recorded with a debit (Dr) or credit (Cr) entry. Bookkeeping is the process of recording the financial transactions of a company on a regular basis.

- Bookkeeping is the process of recording the financial transactions of a company on a regular basis.

- LO 3.5State whether the balance in each of the following accounts increases with a debit or a credit.

- LO 3.4Identify whether each of the following transactions would be recorded with a debit (Dr) or credit (Cr) entry.

- LO 3.2Provide the missing amounts of the accounting equation for each of the following companies.

- LO 3.2LO 3.4West End Inc., an auto mechanic shop, has the following account balances, given in no certain order, for the quarter ended March 31, 2019.

Cash Account: $4,800

Give some examples of transactions that would have resulted in the $4,400 posting to the account. Give some examples of transactions that would have resulted in the $1,900 posting to the account. LO 3.2Provide the missing amounts of the accounting equation for each of the following companies. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License .

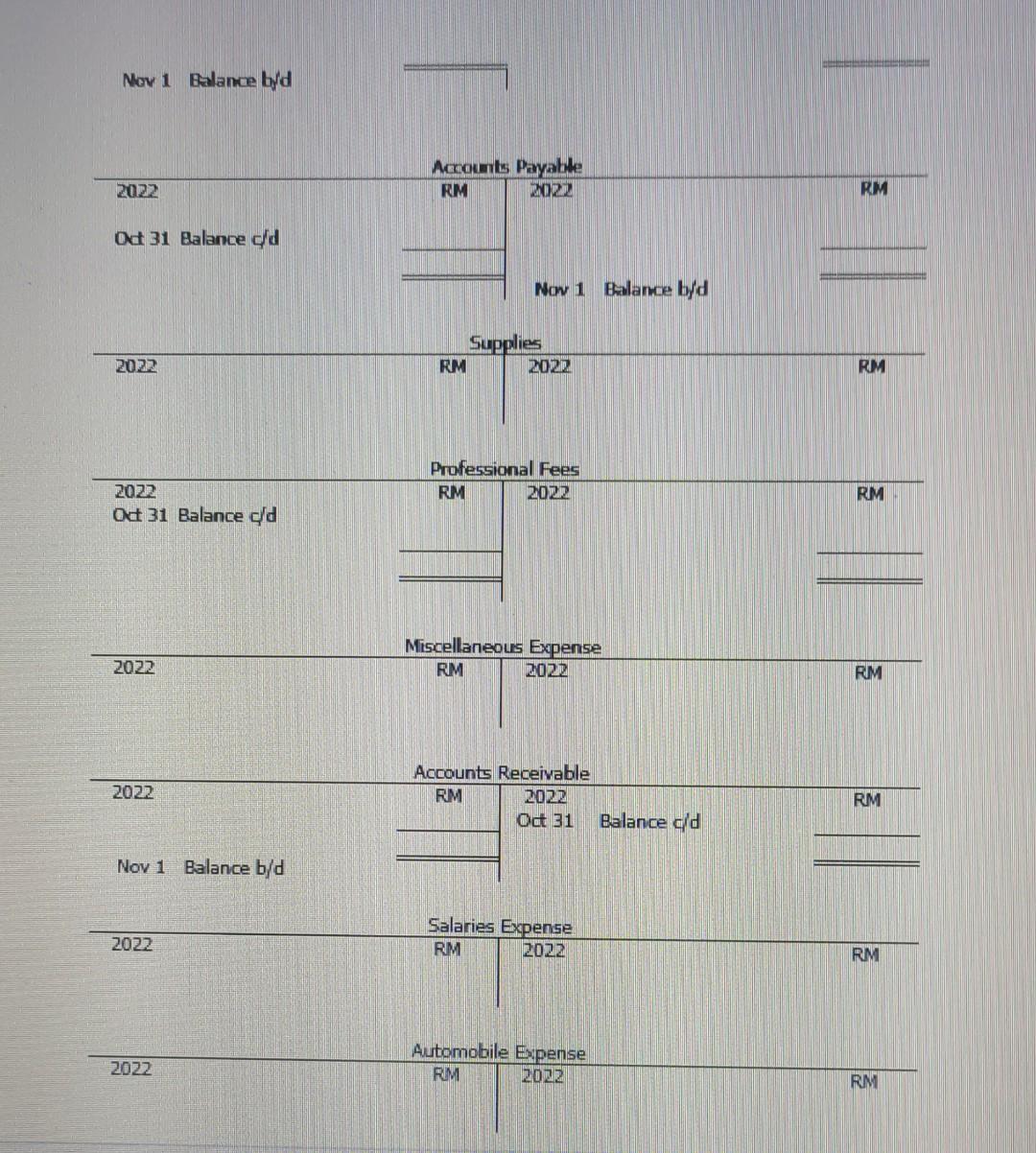

Analyze the following transactions using the T account approach. Place the dollar amount on the debit and credit sides. LO 3.4Identify whether ongoing transactions massachusetts state tax information posted to the following accounts would normally have only debit entries (Dr), only credit entries (Cr), or both debit and credit entries (both).