In conclusion, accounting for rent expense is changing insignificantly from ASC 840 to ASC 842. Now if only the https://www.bookstime.com/articles/bookkeeping-express same thing could be said about the accounting for operating leases. Regardless of whether it’s insurance, rent, utilities, or any other expense that’s paid in advance, it should be recorded in the appropriate prepaid asset account.

LeaseCrunch Blog

Prepaid rent is an asset for the tenant because they are owed a bunch of economic benefits (i.e. the use of the property) due to paying for the rent in advance. Under current accounting conceptual frameworks, this meets the definition of an asset – it’s that simple. To summarize, rent is paid to a third party for the right to use their owned asset. Renting and leasing agreements https://www.instagram.com/bookstime_inc have existed for a long time and will continue to exist for individuals and businesses.

- This is because it has already been prepaid and is not included in the lease liability.

- Instead, prepaid expenses are first recorded on the balance sheet as an asset.

- A common concern of business owners who do accounting by themselves is whether the prepaid rent is an asset or a liability.

- On the 1 of January they pay an advance of $6,000 to cover the first three months of the year.

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Prepaid Rent Vs. Rent Expense: What are the Different?

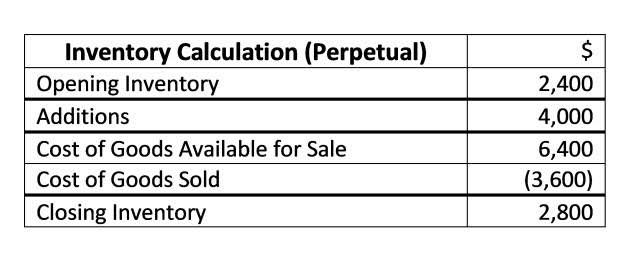

The entry on the liability side is a debit to Lease Expense for $1,749, a debit to Lease Liability for $34,972, and a credit to Cash or AP for $36,721 to record the payment. The entry for the ROU asset is a debit to Lease Expense for $34,972 is prepaid rent an asset and a credit to Right-of-use (ROU) Asset for the same amount. Prepaid or unexpired expenses can be recorded under two methods – asset method and expense method. Both deferred rent and prepaid rent have implications for financial reporting.

Rent Accounting for ASC 842: Prepaid Rent, Journal Entries, and More

The current asset account decreases when the expenses are realized, and the expense account increases. Prepaid rent, prepaid insurance, utility bills, interest, etc., are an entity’s most common prepaid expenses. The process of accounting for prepaid rent involves specific journal entries that capture the initial transaction and the subsequent monthly recognition of rent expense.

- The difference between the actual cash rent payments and the straight-line rent expense is recorded as deferred rent on the balance sheet.

- Meanwhile, some companies pay taxes before they are due, such as an estimated tax payment based on what might come due in the future.

- As time progresses and the rental period elapses, the value of the prepaid rent asset decreases.

- Notice that the amount for which adjustment is made differs under two methods, but the final amounts are the same, i.e., an insurance expense of $450 and prepaid insurance of $1,350.

- Money creation is a fundamental concept in economics and finance, but its accounting mechanisms can be complex and often misunderstood.

- At the initial measurement and recognition of the lease, the company is unsure if or when the minimum threshold will be exceeded.

Prepaid Rent & Accounting

The company can make the prepaid rent journal entry by debiting the prepaid rent account and crediting the cash account after making the advance payment for the rent of facility. In a scenario with escalating lease payments, the average expense recorded is more than the lower payments at the beginning of the lease term. Eventually, the lease payments increase to be greater than the straight-line rent expense. In the case of the rent abatement above, the company begins paying rent but the payments are larger than the average rent expense which includes the abatement period.