Common payroll deductions include federal and state income tax, Social Security tax, Medicare tax, health insurance contributions, retirement contributions, wage garnishments and child support payments. Many payroll products offer integrations with time-tracking apps or include time-tracking features, sometimes at an additional cost. RUN Powered by ADP offers four plans, with many of its more powerful features only included in the top two plans. The application also offers a mobile app for iOS and Android devices, though it is not included in the base pricing. Gusto also assists new users with the initial payroll setup process, getting you up and running quickly. Designed to integrate with QuickBooks Online Accounting, QuickBooks Online Payroll can also be used as a stand-alone payroll software application.

While Rippling, OnPay and Gusto topped our list, there are many more that offer standout features to meet how to find a good accountant for your small business small business payroll needs. The best payroll software for your company depends on your business size and needs. Top payroll services for small businesses include OnPay, Gusto and ADP RUN. Traditional companies offer customizable plans to fit your needs while platforms tailored for startups offer straightforward pricing and all-inclusive packages you can get up and running in minutes. Look for a service that offers essential features like accurate payroll processing, tax compliance and employee self-service options.

- Paycor offers a long list of payroll features, including direct deposit, an employee self-service option, and the ability to pay contractors.

- I would have preferred to be contacted some other way to be asked to buy more products from Wave or its partners.

- But with these handy tips, paying your employees will be easier, more accurate and more streamlined than ever before.

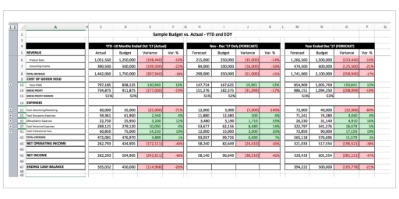

- Your payroll budget should include not only wages and salaries, but also other expenses such as employer-paid taxes, benefits, bonuses, and overtime pay.

The AutoPilot feature is a great option for businesses that pay a high number of salaried employees, and Gusto offers good integration options with a variety of third-party applications. Patriot Payroll offers two plans, Basic which is $10/month and Full-Service, which is $30/month, with a $4 per employee fee added to the base price. The add-on Time and Attendance module is $5/month, with the Human Resources module running $4/month, with each adding an additional $1 per employee fee. While most payroll providers offer similar services, in some cases those services may be included what are the average bookkeeping rates andfees for small businesses in the base price, while in other cases, they are available at an additional cost. As a small business owner, managing payroll is one of the most critical responsibilities you’ll face.

Best for Professional Employer Organization (PEO) Services

Comparing the current payroll to the prior period can also help you spot anything out of the ordinary. Reconciling is a good practice to do every pay period, before filing quarterly taxes and before sending out W-2s to employees. As a business owner, you’re responsible for making sure your payroll is accurate, but that doesn’t mean you need to manage all aspects of the process yourself. In fact, 45% of small businesses use a payroll service, according to a 2021 report by the National Small Business Association. To establish a good system, determine which parts of the payroll process you want to manage in-house and which parts you want to outsource.

Offer Flexible Payment Options

In addition, sometimes you have to choose whom to include in the payroll run. For example, when running biweekly payroll, not all employees were selected, so you have to be sure to check that all the right people are included for each payroll run. When I asked a customer service representative about this, they said that this simply shows that the vacation time is already included in the payroll run. Yet, at other times, when clicking on the time-off icon next to an employee’s name, the system would show “Approve & Include.” Then it was easy to click that button and get rid of the warning. A timekeeping system is a great way to manage your employees’ productivity and calculate their wages, especially if you’re paying hourly rates.

It might be tempting to dip into your payroll tax funds if your business is short on cash. However, borrowing from your tax fund would be a serious mistake that you should avoid at all costs. Document the steps for printing and filing payroll registers and tax reports, along with the names of the individuals to whom you will be handing the paychecks and pay stubs. Creating a standard payroll process will improve your payroll team’s productivity. It can also lower your risk of making payroll mistakes, making your payroll department more reliable.

How to Manage Payroll for Your Small Business

Most payroll services also include benefits administration, so you can use the platform to set up paid time off, retirement plans, insurance and other benefits for employees and integrate benefits with payroll. Many online payroll services include features that help you administer benefits in the same platform, as well as integrations for accounting software. Many offer workers the option to get a payment card, so they can receive money before payday and use the card directly to make purchases. From this screen, I was also given the option to import time tracking data from ADP’s time and attendance add-on or another time keeping software.

Payroll4Free doesn’t cost anything for employers with up to 25 employees, and it remains modestly priced at $12.50 when you add more. OnPay integrates with many third-party applications to simplify the payroll process. You can sync timesheet software with OnPay so you don’t have to enter each employee’s hours by hand. That automation reduces human error and speeds up the amount of time it takes to do payroll. Pre-tax deductions reduce your federal income tax liability, but they don’t necessarily lower all payroll taxes.

Benefits of Outsourcing Payroll

RUN by ADP offers advanced features for automated payroll processing, tax payments and filing and time tracking. Paychex Flex offers bare-bones features to help you manage your payroll runs, such as automated tax filings, payments and calculations; a self-service mobile app for employees; and customizable payroll reporting. The platform offers an easy-to-use basic payroll processing platform to pay employees and contractors, but no HR and benefits administration in its basic Essentials plan.

Users say the service value reporting form is easy to set up and use for both employers and employees and is easily scalable as a company grows. They do wish that Justworks offered more in the way of integrations with popular accounting and other software and some express the need for more customizable platform features. Most, but not all, small business owners need to get an EIN before they can apply for licenses, file payroll taxes or even open a bank account. Depending on where your business is based, you may need to get a state-level EIN on top of your federal EIN. Once you’ve deducted the proper taxes and withheld any deductions from employees’ gross pay, their take-home or net pay is what remains. You’ll pay employees according to their pre-selected receipt method, such as direct deposit, a paper check, or a paycard.